It’s time we revisit “Swap ‘til you drop”

Last week I was in a meeting with a highly respected investment advisor who used the cliché “Swap ‘Til You Drop.” Although I am familiar with the term, I have to admit it struck a particularly strong chord with me this time around. As such, I feel compelled to address its merits.

For those unfamiliar with the concept, swapping ‘til you drop refers to a number of investment strategies including 1031 exchanges, opportunity zones, Delaware Trusts and the like. Using these techniques allows for the transfer of capital from one investment vehicle to another while deferring capital gains taxes and in the event of the owner’s death, avoiding capital gains taxes altogether.

We don’t know how long the Federal Government will support these strategies for, so it’s important for clients to consider their options now, especially considering that the current administration has limited 1031 exchanges to real estate ONLY.

The Stepped-Up Basis

If your client defers capital gains tax through these various investment vehicles until the time of their death, then the property held in the client’s name at the time of death receives a step-up in basis, meaning the property avoids the capital gains tax.

The basis is a property’s market value at the time of death, or in some cases six (6) months after death. This is also referred to as the cost basis. The stepped-up basis on the other hand often carries a much higher value than the cost basis, yet another reason why 1031 exchanges have become so popular.

While 1031 exchanges and stepped-up basis are attractive tax mitigation strategies, there is a catch. Avoiding capital gains tax on a high-value property can potentially result in an even-higher tax (the dreaded “ESTATE TAX”).

If real property or commercial property is left subject to Estate Tax, the government will tax the property at its highest and best use value. In other words, the IRS will now value and tax the property as if it were a commercial business, resulting in a very high tax liability that is due within nine (9) months of the death of the property owner if willed to someone other than a spouse.

This high tax bill often creates a liquidity crisis, and an inability to pay it can result in a 5% per month penalty, plus interest on the tax and penalties due. The common response in situations like this is for families to sell the property in what we call a “Fire Sale” to afford the tax bill.

Due to the unprecedented expenses incurred by the State and Federal Governments as a result of the pandemic, we must anticipate that Estate Taxes and capital gains taxes will become an even greater focal point of the government as a source of capital for the reduction of our new government debt.

A possible solution: Charitable Remainder Trust

Charitable Remainder Trusts (CRTs) are not a new strategy, but for a while they became less popular due to low long-term capital gains rates and high estate tax thresholds. In light of recent events however, it appears the time has come to revisit CRTs.

How Charitable Remainder Trusts Work

Prior to selling a highly appreciated asset, an owner or participant must set up a trust with a proficient estate attorney. Specific language in the trust is very important and not for the faint of heart, so make sure you or your client choose the right counsel to draft these complex documents. Once the trust is formed, ownership of the asset is gifted to the trust.

Because the trust is a charitable entity designed to benefit a church, college or other Section 501(3)(c) entity, the asset is sold at full value in a zero (0) percent tax bracket with no capital gains tax.

The trust can be formed either as a (CRUT) Charitable Unit Trust, or a (CRAT) Charitable Remainder Annuity Trust, both of which pay a fixed income stream to the grantor based on an annual percentage of fair market value chosen by the grantor, plus tax-deductible interest. Whatever remains in the trust at the end of the trust’s term goes to the charity or charities chosen by the grantor.

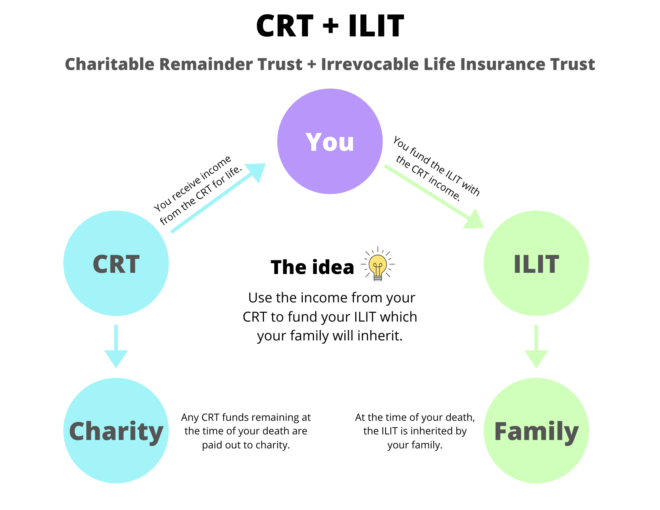

Building Upon the Charitable Remainder Trust

A popular accompaniment to the CRT technique is establishing an Asset Reclamation Trust. With the income stream from the CRUT or CRAT, the client can purchase life insurance inside an Irrevocable Life Insurance Trust (ILIT). The amount of the IRS’ required income stream (in annuity form, together with charitable deduction from the initial funding) is more than sufficient

to replace the value of the asset income and estate tax free to the heirs with liquidity, so that it will be easily divisible in instances with multiple heirs. As with the CRT, a Wealth Replacement Trust should be set up with an insurance professional and an estate planning attorney to ensure that the options selected are in the grantor’s best interest.

In conclusion, the Charitable Remainder Trust, though often overlooked, is a strategy that can truly be the foundation of your estate planning.

In any estate planning you do, you will want a proper professional team of advisors. The Charitable Remainder Trust is a sophisticated planning technique with social benefits for the philanthropically-minded, and lifetime income streams with a reclamation plan for children and grandchildren alike. To accomplish such a holistic strategy, you will need a coordinated team with an estate planning attorney, an insurance professional and a knowledgeable CPA.

If you or your clients are considering selling a major investment and want to understand more about planning opportunities with a CRT or otherwise, please contact us. We can work with your existing team or put one together for you and your clients.